Legislation has finally been passed to give effect to several of the key super changes proposed in the 2021 Federal Budget.

The changes provide opportunities from 1 July 2022 for those of you who are committed to using tax effective investment strategies in the superannuation environment, even for those who are saving for their first home purchase purposes. To make appropriate and informed decisions that meet your circumstances, feel free to contact us for detail discussion.

The legislated changes include:

• Super Guarantee (SG) threshold of $450 per month abolished.

The minimum monthly income threshold that applies to determine eligibility for SG will be abolished. This means that eligible employees who earn less than $450 per month will receive SG from their employer if other eligibility requirements are satisfied.

• removal of the work-test requirement for non-concessional contributions (NCCs) and salary sacrifice contributions, for individuals aged between 67 and 75 will take place. This is such a great opportunity to invest more in line with your risk tolerance level and retirement planning in a tax effective way.

• extending eligibility to make after- tax contributions (NCCs) under the bring-forward rule to individuals aged under 75 will start at the beginning of the financial year. Treasury has clarified that those who are nearing age 75 will be able to bring-forward up to $330,000, subject to meeting other eligibility criteria.

• extending eligibility to make downsizer contributions to those age 60 or over. This will allow eligible individuals to utilise proceeds from the sale of their home to boost retirement savings. Hence, those savings can grow in a concessionally taxed environment – up to 15% in accumulation phase or 0% in retirement phase.

• an increase to the maximum number of voluntary contributions made to super that can be released under the First Home Super Saver Scheme (FHSSS).

The first home Super Saver Scheme can boost your deposit

Currently, up to $30,000 of voluntary super contributions can be released (along with associated earnings) and used for a deposit on a first home. This amount will increase to $50,000, plus associated earnings. This will help individuals by increasing total investments in the concessionally taxed super system for their first home deposit, which may increase total savings available. In doing so they will also manage tax on earnings by simply making personal concessional contributions or salary sacrifice.

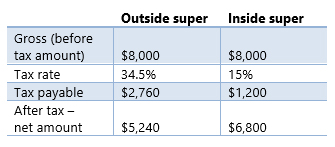

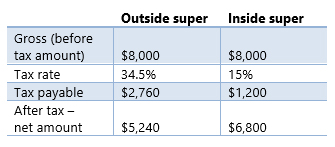

Example: Mila earns $85,000 a year, which means her marginal tax over $37,000 is 34.5%, including Medicare Levy. If Mila saves $8,000 outside super, she pays 34.5 % in tax for every dollar, or $2,760.

By contributing the $8,000 to super, however, there are tax benefits. In doing so, she only pays 15% tax on the contributions that she makes into her super, not 34.5%. This means the $8,000 inside super would attract tax of $1,200, instead of $2,760. That’s a difference of $1,560, simply by moving the savings into super.

What about any tax on the way out?

Like most super savings, tax is payable on the way out. But when it comes to withdrawing the FHSS savings, there’s a 30% tax offset. This means that when Mila releases or withdraws her contributions, she will be taxed at her marginal rate of 32.5%, plus the Medicare Levy (2%), less a 30% tax offset. Hence, in total, she will pay another 4.5% tax when she withdraws her savings plus any earnings, as calculated by the ATO.

This is such a great strategy to increase savings for the first home purchase by using tax effectiveness of superannuation environment. However, the investment options and eligibility requirements need to be very carefully considered. Hence, it is ideal to talk to your financial adviser about this opportunity. Should you know and care of somebody who has been saving for their first home, feel free to share this great opportunity with them.

All these legislated changes will help those who are eligible to save and invest in a superannuation environment for their future financial wellbeing. This will also come with each individual’s responsibility to ensure that their money is invested in line with their goals and risk tolerance level. We have been helping our clients in this area over the last 16 years, and you are welcome to contact us for a 30 minutes free of charge consultation.

DISCLAIMERS

This document has been prepared by HQ Financial Solutions, an Authorized Representative of Lifespan Financial Planning Pty Ltd ABN 23 065 921 735,AFSL No.229892 based on providing for information purpose only. Accordingly, reliance should not be placed on this material as the basis for making a financial or other decision. While all care has been taken in the preparation of this document (using sources believed to be reliable and accurate), to the maximum extent permitted by law, no person including HQ Financial Solutions, Halle Yilmaz or Lifespan Financial Planning Pty Ltd, accepts responsibility for any loss suffered by any person arising from reliance on this information. Before acting on this material, you should consider its appropriateness, having regard to your financial circumstances and needs, and talked to a financial adviser in that field.

2_large.jpg)